Development of Small Business Credit Program

The goal of this job was to develop a program for providing credits to small business for a regional commercial bank.

Throughout the development process of this program, the following tasks were completed in order to provide an integrative approach to the end goal of providing credits for small business:

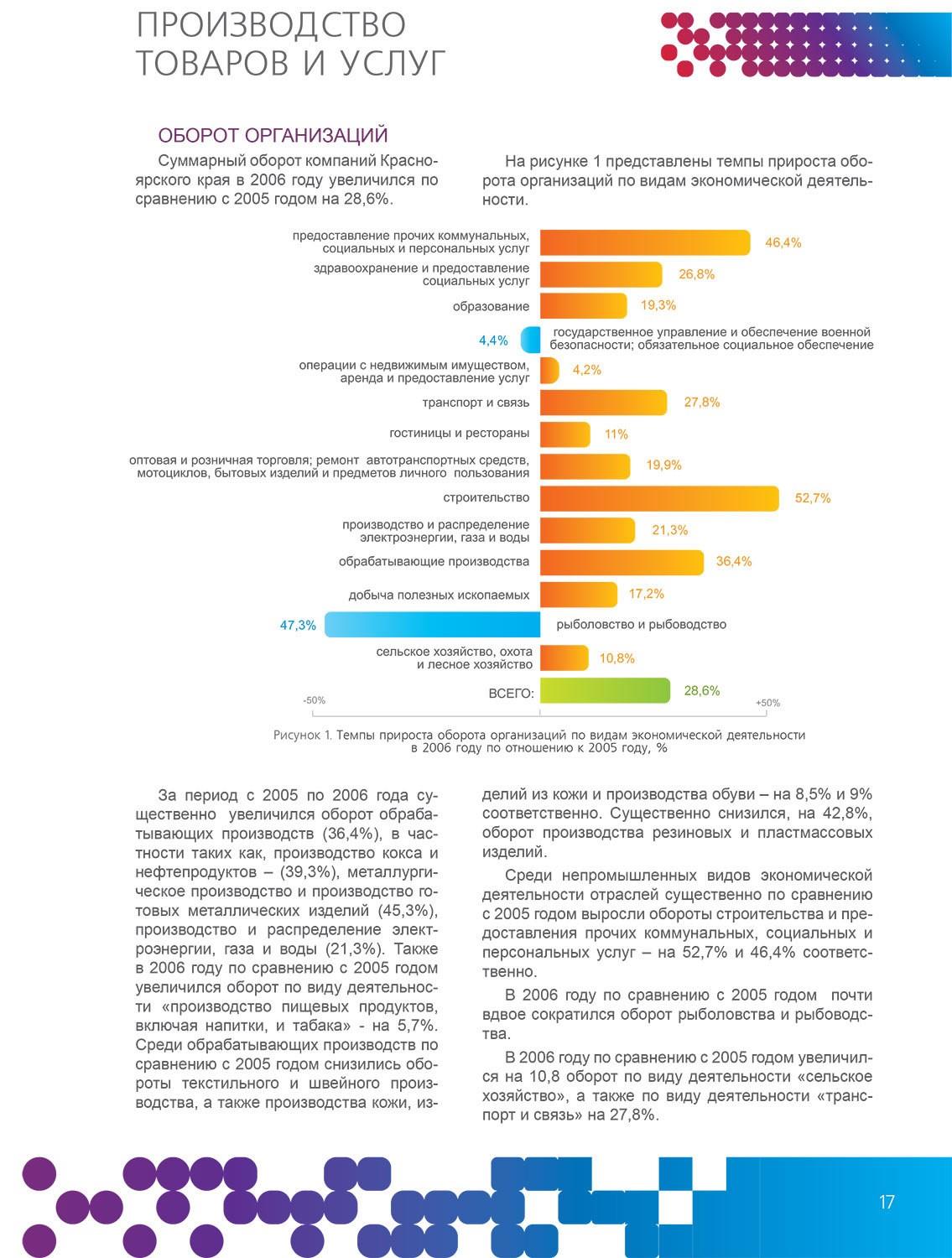

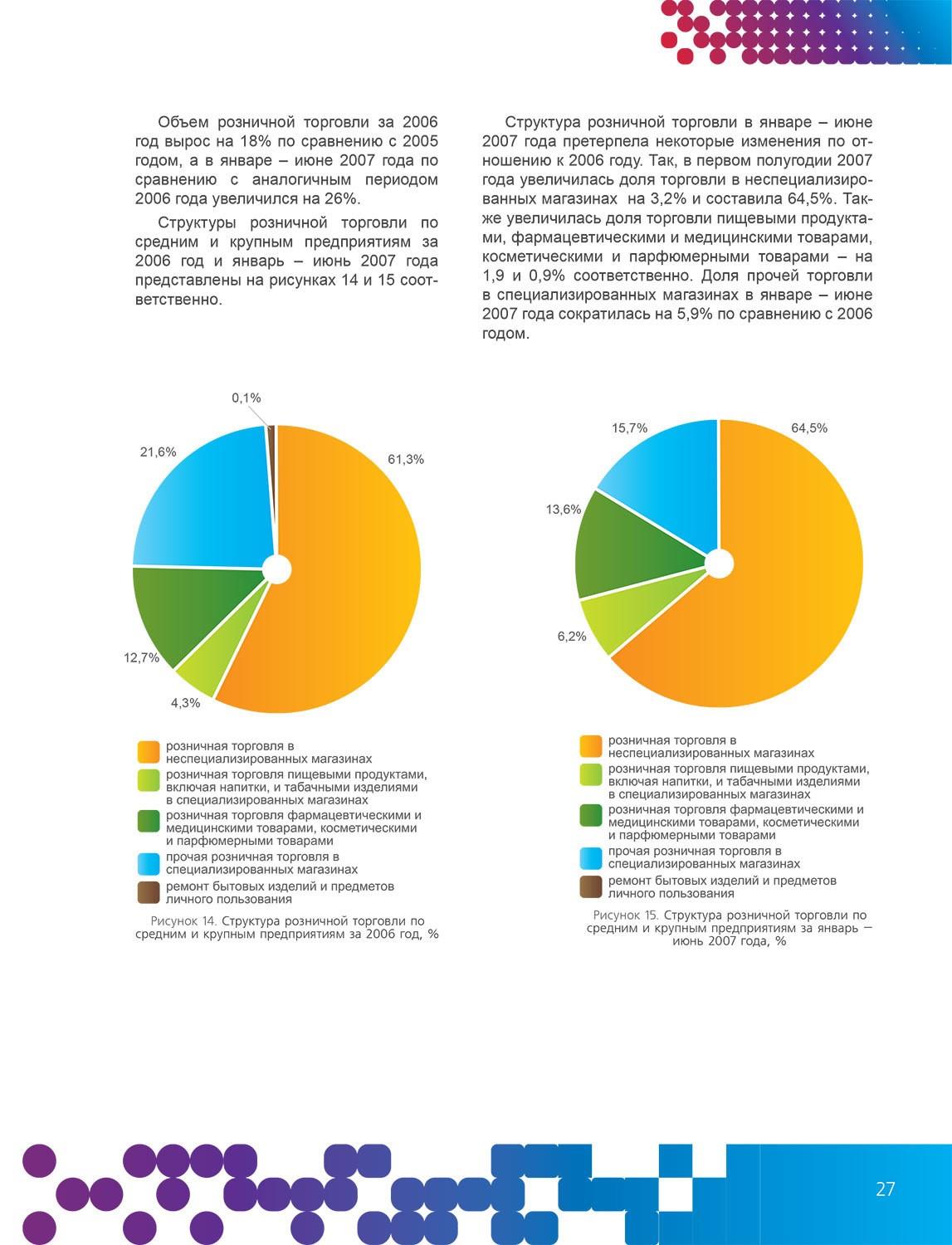

- An analysis of the social – economic development of the Krasnoyarsk Region was conducted according to the most important indicators divided by industry and time. The analysis aimed at uncovering the main tendencies in economic activity development in the region.

- A comparison between social – economic indicators of this and other regions of the Siberian Federal District divided by industry. The goal of the comparison was to uncover the regions that might be potentially attractive to banks.

- An analysis of the Russian and foreign experiences in providing credits for small businesses was conducted. The analysis aimed at learning the best practices both in the area of products offered and in the area of credit checks of potential loan borrowers.

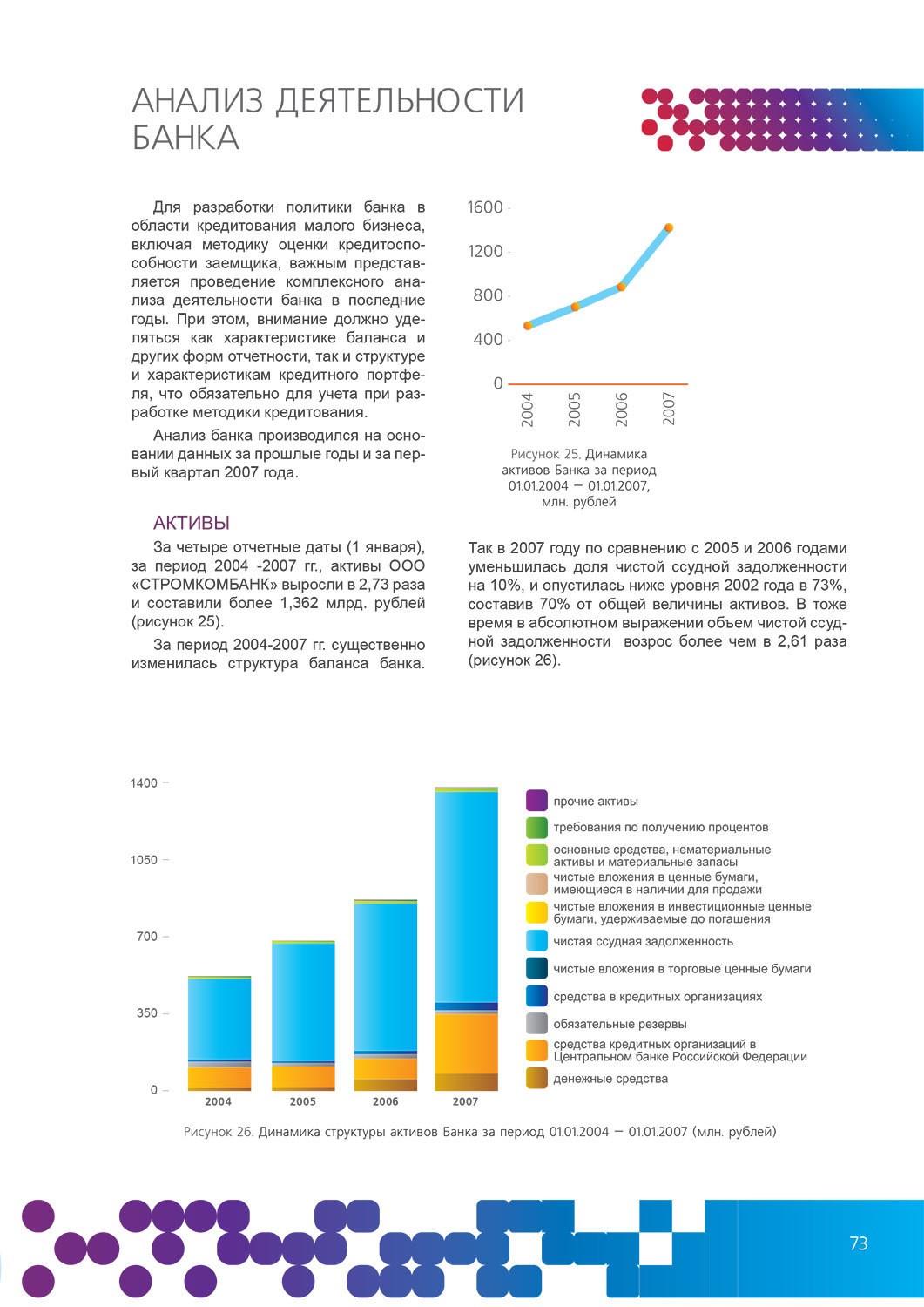

- An analysis of the main indicators of activity and credit portfolio of the Client was performed.

- Using the Russian and foreign experiences in performing credit checks, combined with the Client’s characteristics, indicators of credit safety were developed for small business enterprises. Stop-factors were highlighted.

- Using the international and Russian practices, products for providing credit to small business enterprises were developed.

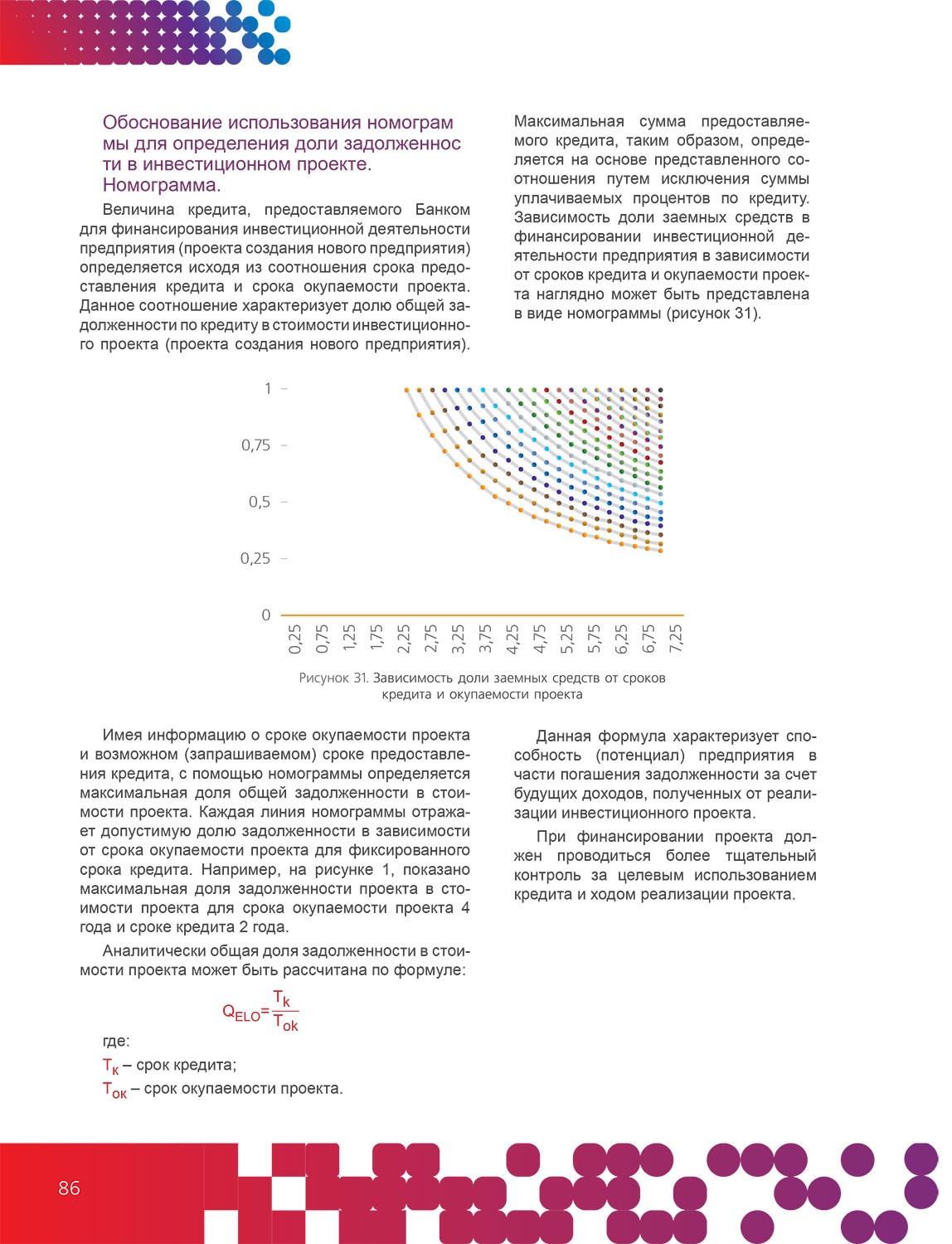

- Based on the investigations that were conducted and the developments of credit products and credit check indicators, a method of credit checking SMEs was developed, including the form of credit fulfillment.

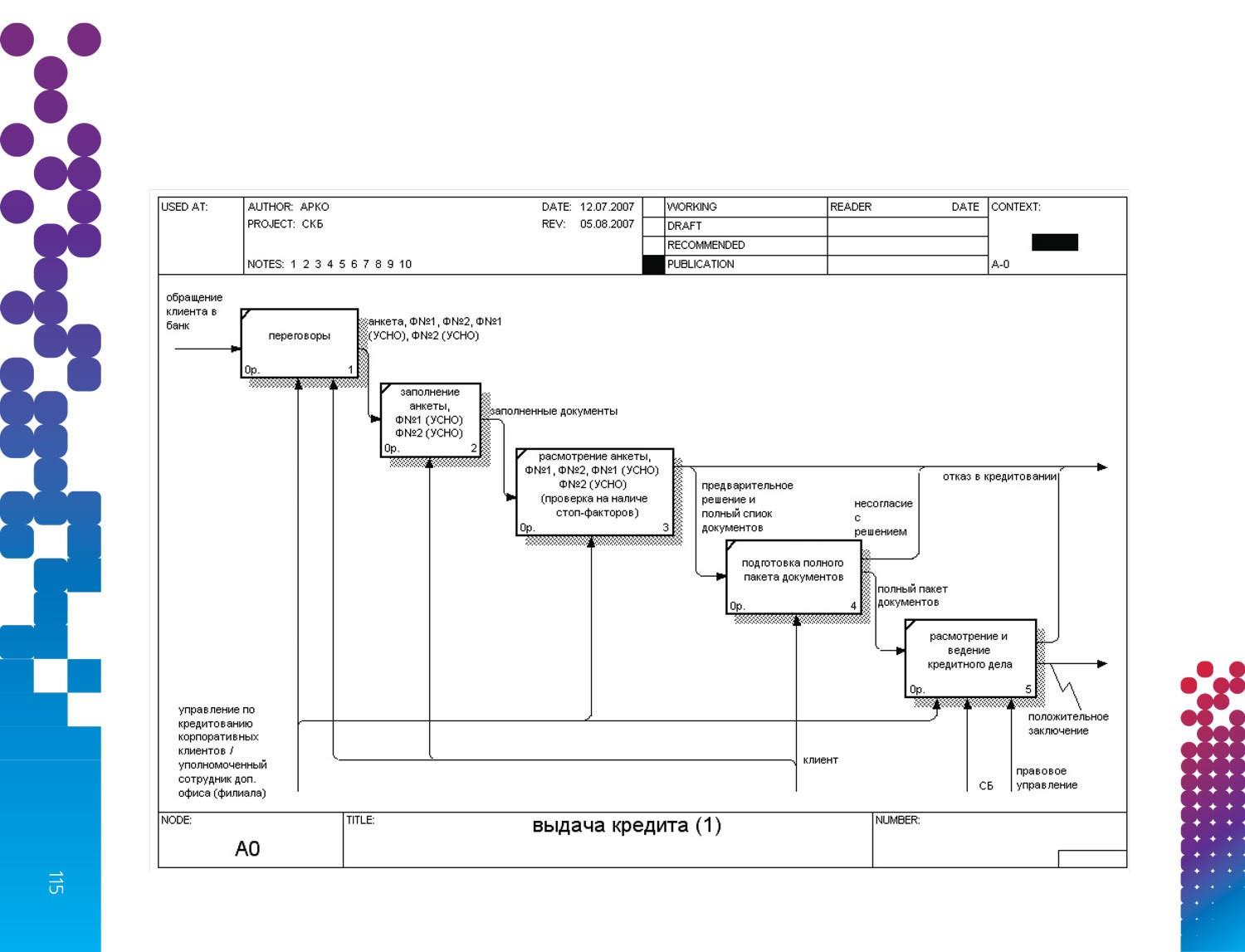

- Business-processes for giving out credits to SMB representatives were developed, which would ensure the connection between all of the previous development and demonstrate the sequence of steps (with accentuation of responsible personnel) when making the decision of providing credit. The processes are written starting from the client’s application and ending with either the approval or denial of credit.

- The process for monitoring credit that was given out was developed, which allows to track both the use of the credit resources that were provided and analyze the change of the client’s rating under the changing qualitative and quantitative indicators.