An audit of the financial and economic activity of the Krasnokamensky Rudnik JSC

Within the audit the following job was performed:

- Analysis was conducted for:

- The actual cost of finished goods, services for each production area by cost, industrial instructions on accounting the expenditures for production, and COGS calculations. The goal was to assess the validity of the accounted costs and to ensure the correctness of dividing expenditures on the types of finished goods and services. In particular, by-products were examined, as was the correct and transparent (actual) COGS for each type of product.

- The operational records for completeness, accuracy and validity of all the main production process stages and all auxiliary and non-core productions. The goal was to identify weaknesses in operational accounting, to systemize the forms of operational accounting and to develop the missing forms of operational accounting.

- The cost standards. The goal was to identify the incorrect use of the standards, cost overruns, as well as to calculate all of the standards that are used with a high degree of reliability.

- The overheads (administrative and semi-fixed expenses). The goal was to identify the unjustified use of company funds and to identify the scope for reducing non-productive costs of the company.

- The accounting of the finished goods, by-products, and other services. The goal was to identify weaknesses in the accounting of finished goods.

- The payroll. The goal was to identify the unjustified use of funds of the company.

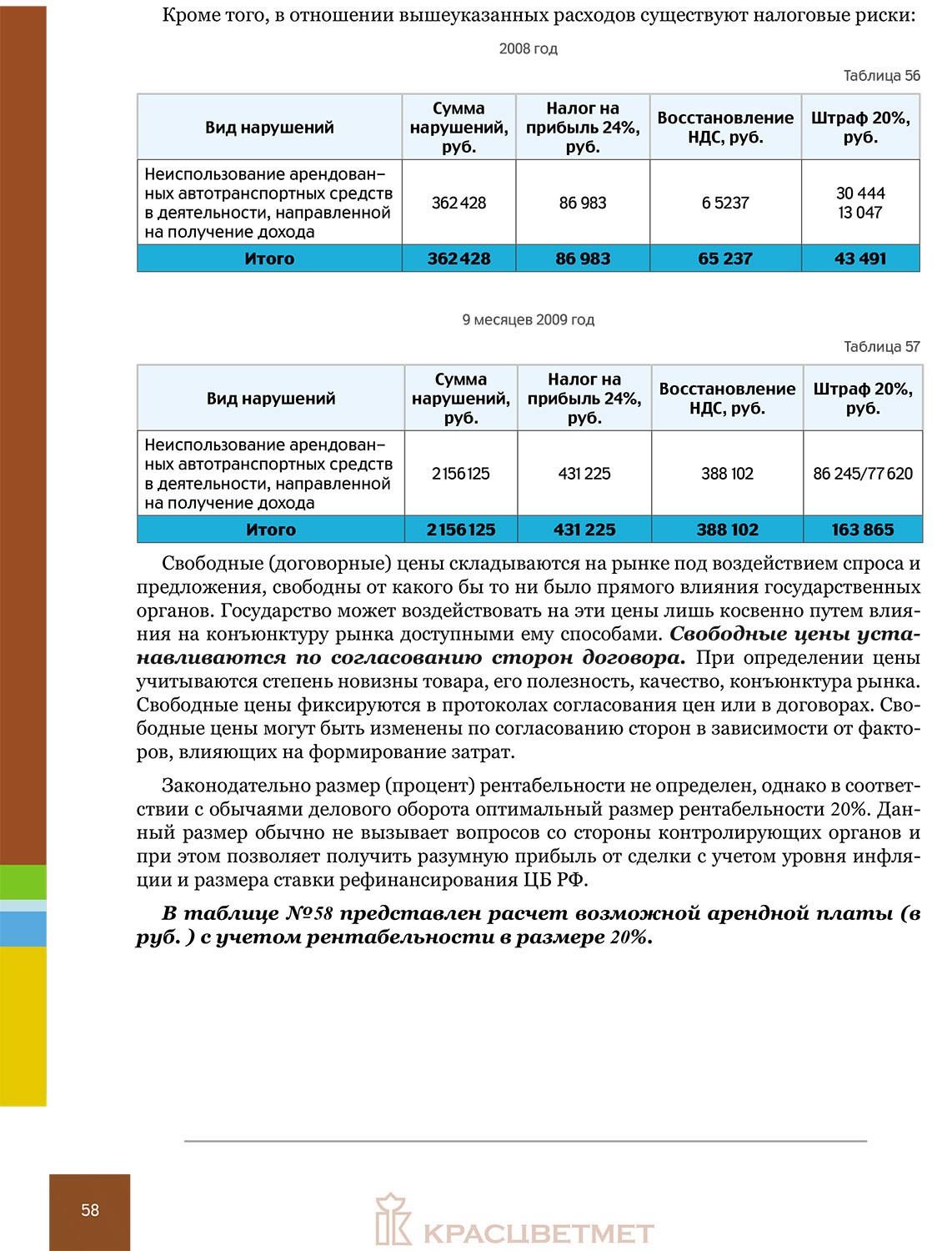

- The leased assets. The goal was to identify the economically unreasonable leasing of fixed assets and to calculate the correct rent.

- Other expenses and revenues. The goal was to identify the incorrect (raised) write-off of expenses and to showcase the incorrect realization of other services.

- The targeted use of credits and loans. The goal is to identify the improper use of credits and loans and to examine the effectiveness of the utilization of raised funds.

- The budget payments. The goal was to identify the correctness of the tax base, the appropriateness of rates, the use of incentives and etc.

- The payments to suppliers and contracts, buyers and customers, debtors and creditors. The goal was to identify the opportunities to reduce accounts payable.

- The economic feasibility of property transactions with affiliated entities. The goal was to identify the lost benefit opportunities on these agreements.

- The effectiveness of labor and employment of personnel. The goal was to identify the scope for improving productivity, reducing staff, and optimizing the organizational structure of the company.

- The validity of costs to launch production. The goal was to determine excessive accounts for financing production launches.

- A monetary evaluation of the damage caused by unstructured operational and financial accounting was evaluated.

- Recommendations were developed on managing the operational, financial and tax accounting.

- Recommendations were developed on the reduction of the company’s tax burden, including changes in accounting policies.